When to start or stop an investment is one of the hardest decisions around. Some people just jump in and get started right away; many wait for a more opportune time – which may mean when the investment has lost some money (those contrarians who look to get a bit of ‘value’), or when the investment is making a lot of money (it feels good to go with a winner).

Similar questions on what to do with investments often arise around differing events, with some investors looking to put their investment on hold before a Fed announcement, big earnings news, or our favorite – “until the Middle East calms down”. Some investors have surely made money – or saved it — by following such gut instincts, but many more have likely had terrible timing by trying to time the market and move to the sidelines. This begs the question of whether you should ever be “on the sidelines”.

Skipping any upcoming drawdowns is obviously a fantastic idea, but without a crystal ball – the only way to do that is by not trading. If you’re not in the game, so to speak, sure you won’t lose – but you also can’t win. The crux of the problem is that you never know what tomorrow will bring. The next trade, or string of trades could be the best the system has ever seen. They could also be the worst, but the most likely scenario is somewhere between those two extremes.

We’ve all seen the various examples in the stock world. But in the real world of trading and automated trading systems – people aren’t really trying to miss singular ‘bad days’ by timing their starts and stops. They go to the sidelines or remain there to miss bad periods spanning many days or weeks or months. So let’s get into the data and see what happens when you try to time an automated system. Are you any better off if you do well and miss the worst 5 or 10 day period. What happens if you’ve got bad timing and miss the best 5 or 10 day period?

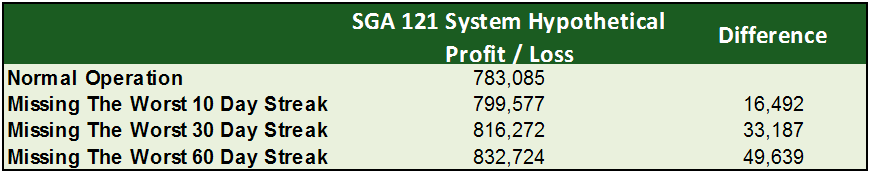

Take for example the best performing system on the iSystems Platform since 2001 “Sistema SGA121,” with a total hypothetical P/L of $783,084.96 since 2001. We went back through the data of the SGA121 system, to see what would have happened if someone was quite good at seeing when trouble was ahead, and was able to avoid the worst 10, 30, and 60 day periods.

(Disclaimer: hypothetical model account performance. Please see full disclaimer below)

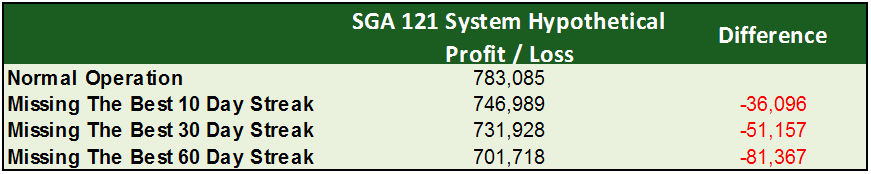

Being able to deftly move to the sidelines looks like a pretty good deal… but what if your’re not so good at it. In fact, what if, by trying to avoid the worst periods – you end up avoiding the best periods. Which isn’t all that far fetched when you consider the best periods are often born out of the worst periods as markets quickly snap back or move from consolidation to expansion, and so on.

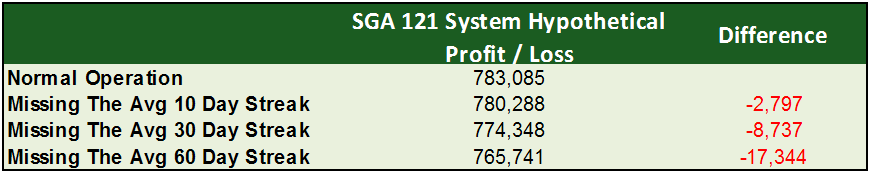

Yikes – the potential savings are hugely outweighed by the potential missed opportunity. Avoiding real costs can cause you to pay more in opportunity cost. But how likely is it that you’re decision to wait on the sidelines results in you missing the very best periods. We would say not so likely – so also looked at what happened if you missed the average 10/30/60 day periods. What sort of average are you giving up in order to avoid the real bad?

So what’s likely to happen when you decide to try to time a system… Well, somewhere between the Best and Worst charts, and likely around that average one. You likely aren’t going to be all-knowing and miss the worst periods, but you likely won’t be the unluckiest person in the world either and miss the best periods. In the best Clint Eastwood accent, “You gotta ask yourself one question… Do I feel Lucky?” The most likely scenario is that you’ll miss the average periods, which in this case means you’ll be hurting yourself by trying to time the investment.

So be careful trying to time a system. In the terminology of America’s baseball pastime, trading systems hit “Home Runs”, not “Base Hits”. So they are constantly trying to survive the less than perfect conditions while waiting for that one big trade. You don’t want to miss that home run trying to avoid the lowly strike out.